Federal Reserve Interest Rate Policy

The Federal Reserve (Fed) is the central bank of the United States. It has a number of responsibilities, including setting interest rates. Interest rates are the prices charged for borrowing money. They play a key role in the economy, affecting everything from consumer spending to business investment.

The Fed’s primary goal is to promote economic growth and stability. It does this by setting interest rates at a level that it believes will help the economy achieve these goals.

Types of Interest Rates Set by the Fed

The Fed sets a number of different interest rates, including:

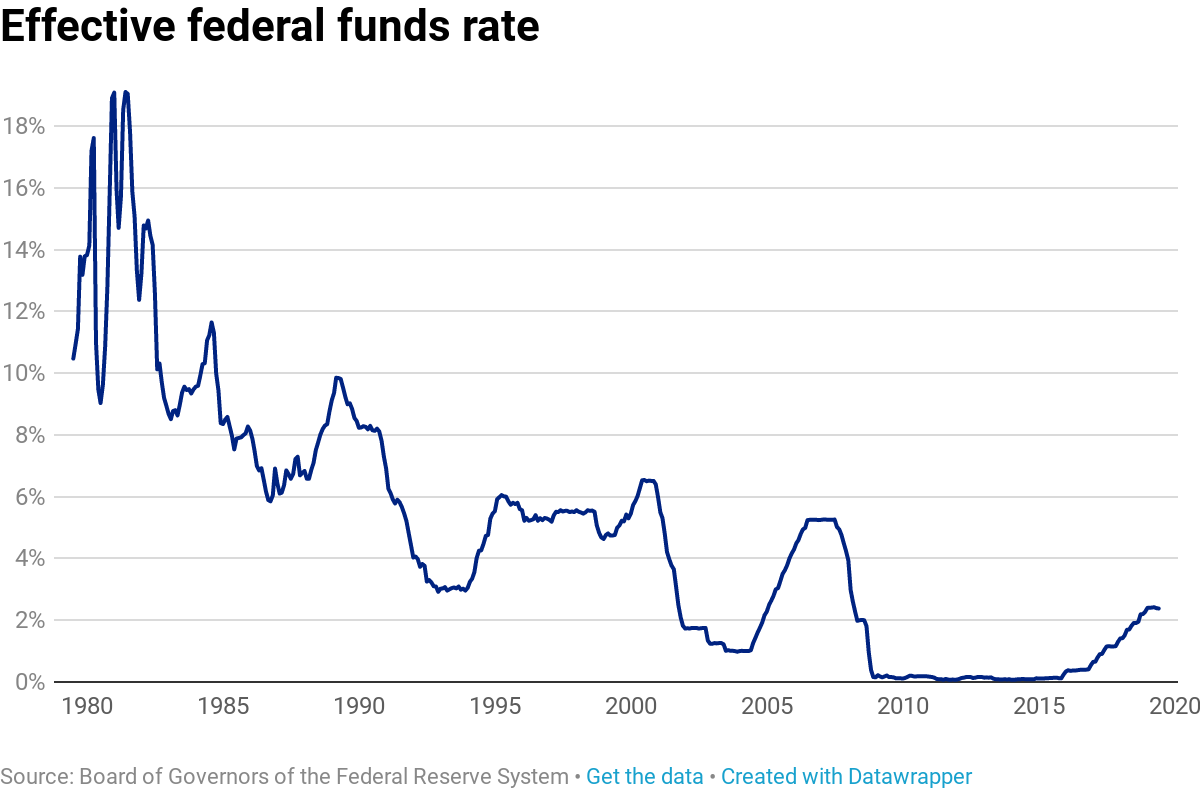

– The federal funds rate: This is the interest rate that banks charge each other for overnight loans.

– The discount rate: This is the interest rate that the Fed charges banks for loans.

– The prime rate: This is the interest rate that banks charge their best customers for loans.

Impact of Interest Rate Changes on the Economy, Federal reserve interest rates

Changes in interest rates can have a significant impact on the economy. For example, when the Fed raises interest rates, it becomes more expensive for businesses to borrow money. This can lead to a decrease in business investment, which can slow economic growth. Conversely, when the Fed lowers interest rates, it becomes less expensive for businesses to borrow money. This can lead to an increase in business investment, which can boost economic growth.

Factors Influencing Federal Reserve Interest Rate Decisions: Federal Reserve Interest Rates

Federal reserve interest rates – The Federal Reserve, the central bank of the United States, sets interest rates to influence economic activity and maintain price stability. When making interest rate decisions, the Fed considers various economic indicators that provide insights into the health of the economy.

Inflation

Inflation is a key factor in interest rate decisions. The Fed aims to keep inflation low and stable, typically around 2%. When inflation is too high, the Fed may raise interest rates to slow economic growth and reduce price pressures. Conversely, if inflation is too low, the Fed may lower interest rates to stimulate economic activity and boost inflation.

Unemployment

The Fed also considers unemployment when setting interest rates. A low unemployment rate indicates a strong economy, which may lead the Fed to raise interest rates to prevent inflation from rising. On the other hand, a high unemployment rate may prompt the Fed to lower interest rates to encourage job creation and economic growth.

Economic Growth

The Fed monitors economic growth to assess the overall health of the economy. Strong economic growth may lead to higher interest rates to prevent inflation from overheating the economy. Conversely, weak economic growth may prompt the Fed to lower interest rates to stimulate economic activity.

Global Economic Conditions

The Fed also considers global economic conditions when setting interest rates. Economic conditions in other countries can impact the U.S. economy through trade, investment, and currency exchange rates. For example, if the global economy is slowing down, the Fed may lower interest rates to support U.S. economic growth.

Implications of Federal Reserve Interest Rate Changes

Interest rate changes implemented by the Federal Reserve can have significant implications for businesses and consumers. These adjustments influence economic activity, impacting investment, spending, and overall financial stability.

Impact on Businesses

Interest rate changes affect businesses in several ways. Higher interest rates can increase borrowing costs for businesses, making it more expensive to finance investments and expansion plans. This can slow down economic growth and reduce business profitability. Conversely, lower interest rates can stimulate business activity by making it cheaper to borrow and invest.

Impact on Consumers

Interest rate changes also impact consumers. Higher interest rates can lead to increased borrowing costs for mortgages, auto loans, and credit cards. This can reduce consumer spending and slow down economic growth. Conversely, lower interest rates can make it cheaper for consumers to borrow and spend, boosting economic activity.

Consequences of Rapid or Gradual Interest Rate Changes

The pace of interest rate changes can also have consequences. Raising or lowering interest rates too quickly can create economic instability and disrupt financial markets. Gradual changes, on the other hand, allow businesses and consumers to adjust more smoothly and minimize the potential for negative impacts.

Long-Term Effects of Sustained Low or High Interest Rates

Sustained low or high interest rates can have long-term effects on the economy. Prolonged low interest rates can lead to inflation, asset bubbles, and financial imbalances. Conversely, prolonged high interest rates can slow down economic growth, reduce investment, and increase unemployment.

The Federal Reserve’s recent interest rate hike has sent ripples through global markets, impacting economies from México and Brazil to Europe and Asia. While the hike is expected to curb inflation in the United States, it could also lead to slower growth in emerging markets, as investors shift their funds to safer assets.

The full impact of the rate hike remains to be seen, but it is likely to continue to shape the global economic landscape in the months and years to come.

While the Federal Reserve deliberates on interest rates, soccer fans can catch some exciting soccer games today. The high-stakes matches promise thrilling action, with top teams battling it out for victory. As the Fed weighs its decisions, soccer enthusiasts can find respite in the passion and drama of the beautiful game, before returning to the financial news and the impact of interest rate changes on the economy.

The Federal Reserve’s interest rate decisions have a significant impact on the global economy, influencing everything from stock markets to currency exchange rates. These decisions are closely watched by investors and businesses alike, as they can have a profound effect on economic growth and stability.

Even events like the upcoming Copa America 2024 can be affected by the Fed’s monetary policy, as changes in interest rates can impact consumer spending and investment.

As the Federal Reserve continues to raise interest rates in an effort to curb inflation, many Americans are facing financial hardship. For those who rely on Social Security benefits, the recent $600 increase in Supplemental Security Income (SSI) payments social security $600 increase ssdi has provided some relief.

However, with the rising cost of living, many seniors and disabled individuals are still struggling to make ends meet. The Federal Reserve’s interest rate hikes are likely to continue in the coming months, which could further strain the finances of those who rely on fixed incomes.

The Federal Reserve’s decision to raise interest rates has had a ripple effect on the financial markets. Investors are closely watching the situation, as the Fed’s actions could have a significant impact on the economy. Francisco Alvarez , a financial analyst, believes that the Fed’s decision is a positive step towards curbing inflation.

He notes that the economy has been growing at a strong pace, and that raising interest rates will help to cool things down.